Trump’s New Bill Brings Big Changes to Student Loans

If you’re a student, planning to go for higher studies, or a parent saving for your child’s education — this news is important for you.

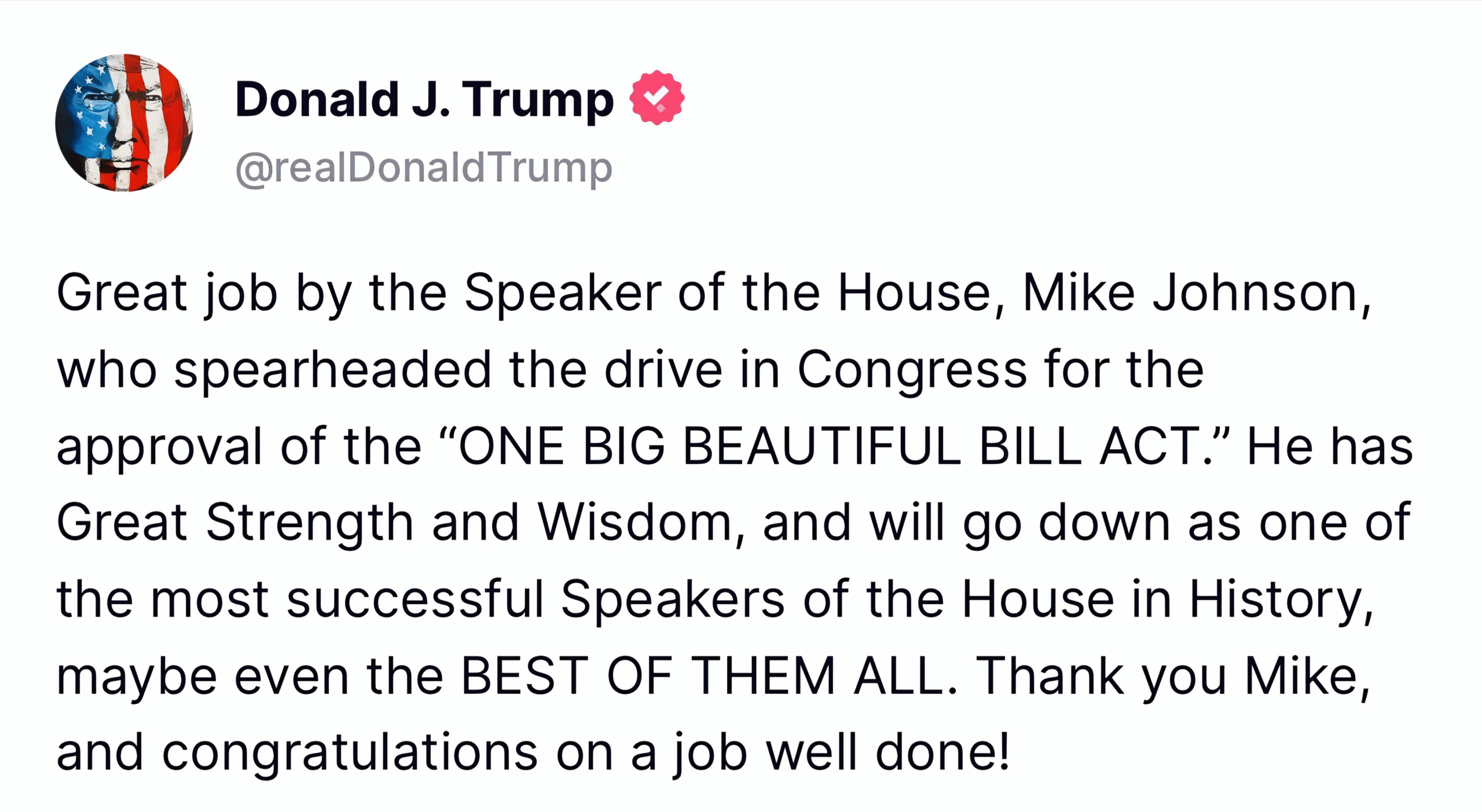

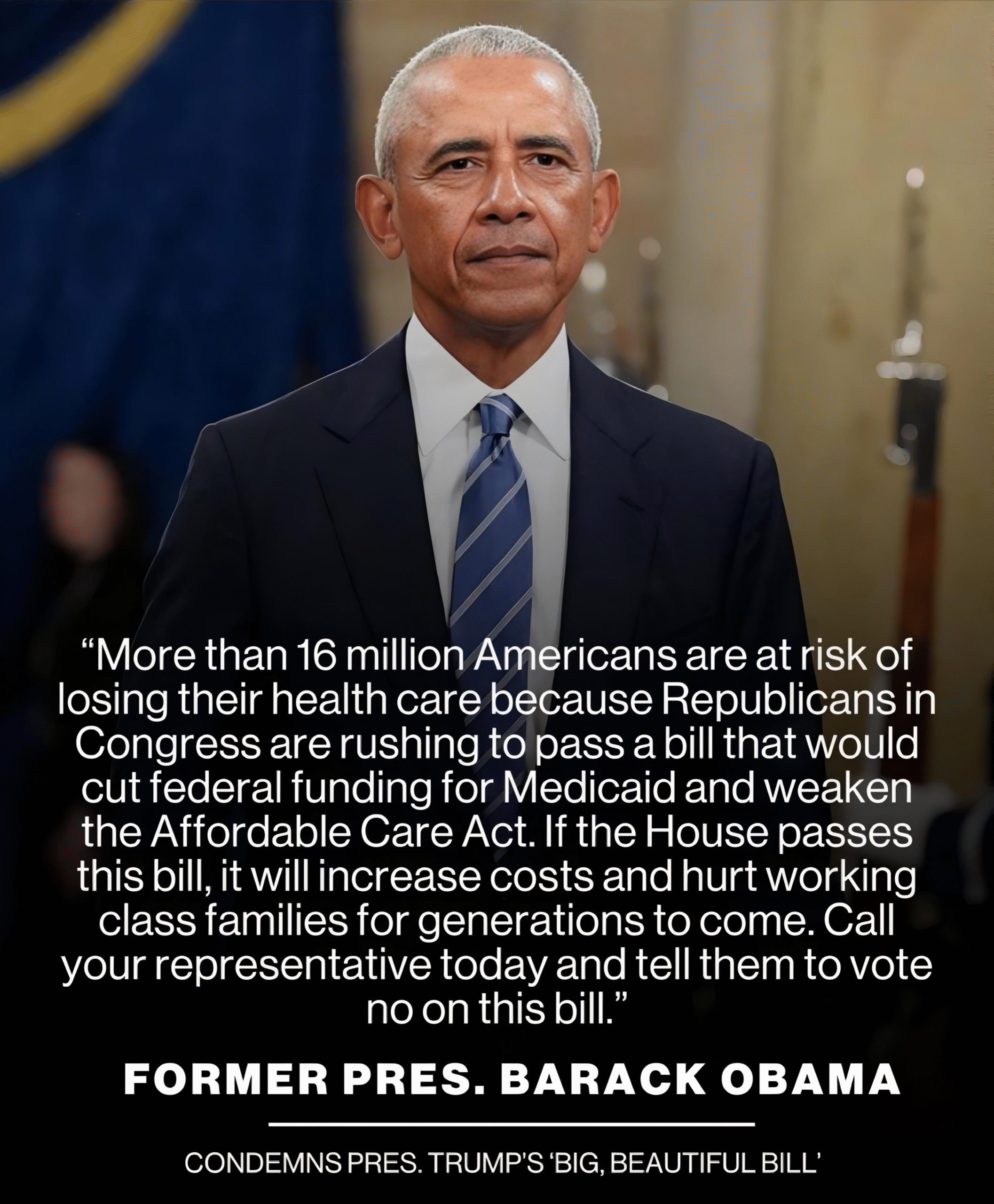

A new government bill, nicknamed the “Big, Beautiful Bill,” has just passed in the U.S. Congress and is now waiting for Donald Trump’s signature. Once signed, it will bring major changes to how student loans work in America.

Let’s explain it in a simple and easy way so everyone can understand.

What Is This New Bill About?

This bill is nearly 900 pages long, and it changes a lot of things — from tax cuts to healthcare to student loans. One of the biggest impacts will be on federal student loans — which many students rely on for college or higher education.

Here’s what’s changing.

New Loan Limits for Students

The bill sets strict caps (limits) on how much money students and parents can borrow from the government.

- Graduate students can borrow up to $100,000 only

- Medical & Law students can borrow up to $200,000

- Parents can borrow only up to $65,000 under Parent PLUS loans

Earlier, students and parents could borrow more if needed. But now, these fixed limits may not cover full college costs, especially in expensive universities.

Repayment Plans Are Changing Too

Until now, students had many repayment options, including income-based plans — where monthly payments depended on how much money you earned.

But now, only two repayment options will remain:

1. Standard Plan

Pay your loan over 10 to 25 years, depending on the amount you owe. Your income doesn’t matter — the payments are fixed.

2. Repayment Assistance Plan

You pay between 1% to 10% of your extra income (after covering basic needs). Still harder for low-income borrowers.

Also, loan forgiveness programs — which helped cancel loans after a few years of payments — are being removed. This could hurt people with low salaries the most.

What About Parents?

Parents who take loans to help their kids go to college will now face more limits:

- Max loan: $65,000

- No option to repay based on income

- No forgiveness programs

That means less help for families, and more pressure to repay, even if money is tight.

What Happens to Biden’s SAVE Plan?

President Biden introduced the SAVE plan, which helped around 8 million borrowers pay less each month, based on income.

But under this new bill:

- SAVE may be cancelled or changed

- Borrowers must switch to a new plan between July 2026 and June 2028

- If they don’t, they’ll be automatically moved to the new “Repayment Assistance Plan”

Right now, the courts are deciding if SAVE will stay legal. Until then, many borrowers are stuck in limbo.

Who Will These Changes Affect?

These new rules will mostly apply to:

- New borrowers who take loans after the bill becomes law

- Students planning to go to graduate school, medical school, or law school

- Parents who plan to borrow for their children’s college education

People who already have student loans may not be affected immediately — but future plans could become harder.

Final Thoughts

College dreams may become more expensive and difficult if this bill becomes law. Students will face less loan support, fewer repayment choices, and more financial pressure — especially if they come from low or middle-income families.

If you or someone you know plans to take student loans, now is the time to stay alert, plan smart, and look for scholarships or financial aid.